In the rapidly evolving landscape of the healthcare industry, the role of the chief financial officer has never been more critical. As healthcare organizations face increasing pressures from regulatory requirements, technological advancements, and shifting patient demographics, CFOs must strategically lead their organizations toward financial excellence and sustainable growth. Today's CFOs are not just stewards of financial management; they are pivotal players in driving business strategy, risk management, and operational efficiency.

With backgrounds often enriched by advanced education, such as an MBA from prestigious institutions like the Kelley School of Business at Indiana University, modern CFOs leverage their expertise to navigate complex financial environments. They engage in acquisition integration, foster relationships with stakeholders, and implement measures for cost reduction and productivity improvement. By building trust and mutual respect within their teams and establishing solid connections with the board of directors, these financial leaders enhance decision-making processes and position their organizations for success in an ever-competitive marketplace.

The Evolving Role of the CFO in Healthcare

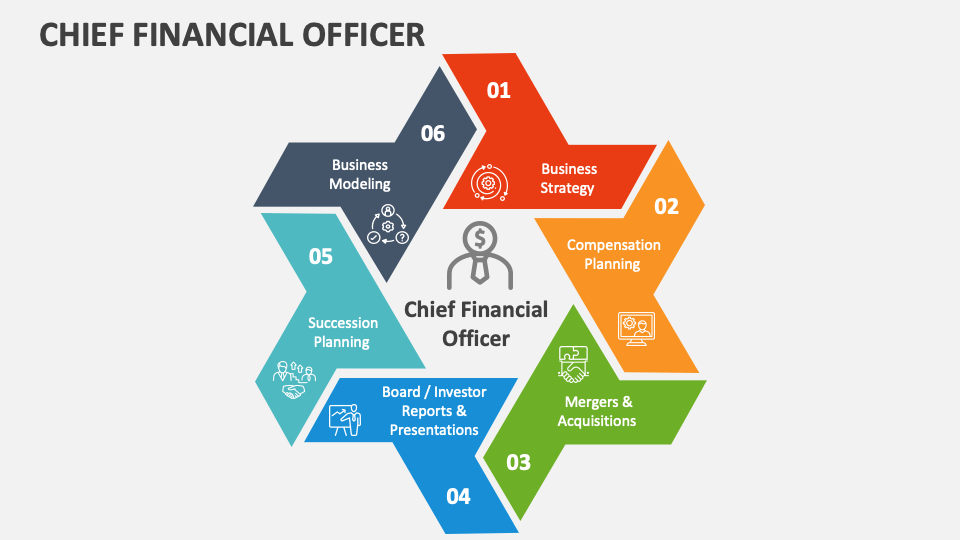

The role of the Chief Financial Officer in the healthcare industry has significantly evolved in recent years, transitioning from traditional financial management to a more strategic leadership position. Today's CFOs are not just responsible for overseeing financial operations; they also play a critical role in shaping the overall business strategy within healthcare organizations. This shift is driven by the need for advanced financial insights, risk management frameworks, and the integration of new technologies that can enhance operational efficiency and improve patient care outcomes.

CFOs in healthcare are increasingly involved in acquisition integration and business development initiatives. As healthcare systems seek to grow through mergers and partnerships, the CFO's expertise in evaluating financial stability and guiding investment decisions becomes essential. Their ability to assess the financial impact of new technologies, such as biotechnology and cellular immunotherapies, is crucial for ensuring that the organization remains competitive and responsive to the evolving landscape of cancer treatment and other critical healthcare areas.

Moreover, relationship building and mutual respect among stakeholders, including the board of directors and operational teams, are vital for the CFO to achieve financial excellence. Effective leadership in this capacity cultivates a culture of transparency and collaboration, resulting in improved productivity and cost reduction efforts. By engaging with various departments and understanding their financial needs, the CFO can drive initiatives that not only enhance financial performance but also support the broader mission of providing high-quality healthcare services.

Learn More from Jeffrey Hammel

Risk Management Strategies for CFOs

Effective risk management is a cornerstone of a CFO's responsibilities, especially in the dynamic healthcare industry. CFOs must adopt a proactive approach to identify potential risks associated with financial operations, regulatory compliance, and patient care. This involves continuous monitoring of internal controls, financial reporting processes, and adherence to industry regulations. Developing a comprehensive risk management framework allows CFOs to mitigate financial risks while ensuring that the organization remains agile in response to unforeseen challenges.

Additionally, CFOs play a vital role in integrating risk management into the overall business strategy. By aligning financial planning with risk assessment, CFOs can make informed decisions regarding investments, acquisitions, and operational efficiency. Utilizing data analytics and predictive modeling helps CFOs anticipate risk exposure and respond appropriately. Building strong relationships with other C-suite executives, particularly those involved in compliance and operational management, fosters a collaborative environment where risk is effectively communicated and managed across departments.

Finally, strong leadership is key to embedding a culture of risk awareness throughout the organization. CFOs must promote an atmosphere of mutual respect and trust, encouraging team members at all levels to participate in identifying and addressing potential risks. Regular training and open dialogues about risk management can significantly enhance organizational resilience. By establishing clear lines of accountability and empowering employees, CFOs can effectively drive a mindset focused on proactive risk management, ultimately contributing to long-term financial success and growth.

Streamlining Acquisition Integration Processes

Acquisition integration is a critical component of a CFO's strategic role in the healthcare industry. A successful integration process begins with thorough planning and clear communication. The CFO must work closely with all stakeholders, including the board of directors and corporate operations teams, to establish a shared vision and roadmap for the integration. This collaborative approach helps to mitigate risks and align objectives, ensuring that the new entity maintains operational efficiency while transitioning into a cohesive organization.

A well-defined framework is essential for managing the complexities of acquisition integration. The CFO should implement standardized procedures for assessing financial and operational compatibilities between the merging entities. This involves conducting extensive due diligence, including financial audits and evaluations of existing business practices. By identifying potential challenges early in the process, the CFO can develop tailored strategies that emphasize productivity improvement and cost reduction, ultimately enhancing the value generated from the acquisition.

Furthermore, nurturing relationships during the integration period is vital. The CFO should foster an environment of mutual respect and trust among the teams from both organizations. This can be achieved through regular communication, team-building activities, and transparent reporting. By prioritizing relationship building, the CFO can enhance employee morale and engagement, which is essential for a smooth integration. Cultivating a culture of collaboration not only eases the transition but also positions the organization for long-term success in its business strategy and development goals.

Learn More from Jeffrey Hammel

Effective Business Planning and Development

In the rapidly evolving healthcare industry, effective business planning and development are critical for navigating complexities and fostering growth. The CFO plays a pivotal role in this process by leveraging financial expertise to inform strategic decisions. This includes analyzing market trends, forecasting financial outcomes, and identifying opportunities for expansion, such as potential mergers or acquisitions. With a strong foundation from institutions like the Kelley School of Business, CFOs are equipped with the analytical skills necessary to guide organizations toward sustainable growth while managing associated risks.

Successful business development also hinges on relationship building. A CFO must engage with various stakeholders, including the board of directors, operational teams, and external partners. Establishing mutual respect and open communication fosters collaboration and trust, essential components in achieving organizational goals. As healthcare companies increasingly seek private funding and partnerships, the CFO's ability to articulate the value proposition becomes paramount. This is especially true when courting investors for initiatives in cutting-edge fields like biotechnology and cellular immunotherapies.

Learn More from Jeffrey Hammel

Furthermore, the CFO oversees the implementation of business strategies that align with the organization’s financial management objectives. By continually assessing operational efficiency and monitoring finance operations, the CFO can identify areas for productivity improvement and cost reduction. This proactive approach not only ensures that the financial health of the organization is maintained but also positions it for future success in a competitive landscape. Through strategic planning and effective execution, the CFO helps steer the organization towards achieving its long-term vision of excellence in healthcare delivery.

Enhancing Financial Management and Auditing Practices

In the dynamic healthcare industry, enhancing financial management and auditing practices is crucial for ensuring organizational success and sustainability. Chief Financial Officers must adopt a proactive approach to financial oversight, focusing on transparency and accountability. Implementing robust financial controls and regular audits not only helps in identifying discrepancies and preventing fraud but also builds trust among stakeholders. This trust is foundational for effective relationship building with the board of directors and ensuring that the organization's financial practices align with its strategic goals.

Furthermore, leveraging technology and advanced analytics plays a vital role in improving financial operations. The integration of financial management software and real-time data analytics allows CFOs to gain deeper insights into financial performance, streamline processes, and make informed decisions. This leads to better resource allocation, enhanced operational efficiency, and ultimately supports the organization’s growth trajectory. Additionally, incorporating regular training for finance teams on best practices in auditing enhances their capabilities and fosters a culture of continuous improvement.

Collaboration between finance and other departments is essential for achieving comprehensive financial health. By fostering mutual respect and open communication, CFOs can ensure that all teams are aligned with the organization’s objectives. This collaboration not only enhances productivity but also enables cost reduction initiatives that are vital in a competitive healthcare environment. As CFOs navigate complex financial landscapes, their focus on enhancing auditing practices while fostering collaborative relationships will drive financial excellence and support innovative solutions in patient care, such as biotechnology and cellular immunotherapies.

Building Relationships with Stakeholders

In the ever-evolving healthcare industry, the ability of a CFO to build strong relationships with stakeholders is paramount. Stakeholders include not only the board of directors and investors but also employees, patients, and suppliers. A chief financial officer must effectively communicate the organization’s financial strategy while fostering mutual respect and trust. This involves being transparent about the financial health of the institution and engaging stakeholders in discussions about strategic priorities, which in turn enhances collaboration and commitment to shared goals.

A successful CFO employs relationship-building strategies that prioritize understanding the needs and concerns of various stakeholders. Regular updates on financial performance, risk management initiatives, and business development efforts can strengthen these relationships. This open line of communication allows stakeholders to feel valued and heard, which can facilitate smoother decision-making processes, especially during crucial moments such as acquisition integration or major financial planning initiatives.

Moreover, strong relationships can lead to opportunities for innovation and improvement in financial management practices. By leveraging insights from different stakeholders, a CFO can identify areas for productivity improvement, cost reduction, and operational efficiency. Building a network of trust among stakeholders not only supports immediate objectives but also contributes to the long-term sustainability and growth of healthcare organizations, ensuring they can navigate challenges effectively while driving financial excellence.

Driving Productivity Improvement and Cost Reduction

In the ever-evolving healthcare landscape, Chief Financial Officers play a pivotal role in enhancing productivity and reducing costs. By leveraging data analytics and performance metrics, CFOs can identify operational inefficiencies and areas where waste occurs, ultimately striving for streamlined workflows. This analytical approach enables healthcare organizations to allocate resources more effectively, ensuring that each department operates at peak productivity, which is essential for delivering high-quality patient care while managing expenses.

CFOs also need to foster a culture of mutual respect and collaboration among teams to drive cost-effective solutions. By building strong relationships with clinical and administrative leaders, they can align financial strategies with clinical goals. This cooperation facilitates the implementation of best practices in financial management and operational efficiency, leading to innovative cost reduction strategies without compromising service quality. For instance, engaging in discussions about resource utilization can lead to centralized purchasing or shared services, greatly reducing overhead costs.

Moreover, effective debt management and securing private funding are crucial for long-term sustainability in the healthcare sector. CFOs must navigate these financial avenues carefully, ensuring that investments in new technologies, such as biotechnology and cellular immunotherapies, do not strain existing resources. Through careful planning and risk management, CFOs can drive strategic acquisitions and integration initiatives that enhance overall operational performance, positioning their organizations for both immediate and future success while maintaining fiscal responsibility.